“We will first stir up great chaos under heaven, then bring about great order under heaven.”

Mao Zedong, in a letter to his wife, Jiang Qing, July 8, 1966

It is easy to understand why some investors and corporate directors want to ignore China. Chaos in Washington over tariffs will continue. Xi Jinping may struggle to revive confidence and domestic demand. But, being unprepared for China is risky.

Despite the political chaos, several aspects of China’s role in the global economy are unlikely to change:

China will remain the world’s second-largest and fastest-growing consumer market. You may not have heard of Mixue, for example, but with 46,000 franchise stores across China, Southeast Asia, Japan, South Korea and Australia, the tea and ice cream company has more global outlets than Starbucks. Since its March 3 IPO in Hong Kong, which was 6,000 times oversubscribed, the share price has more than doubled.

World-class competitors will continue to come from China, where the government is expanding fiscal support for innovation while Washington is slashing spending on education and science. DeepSeek won’t be the last Chinese company to surprise us. Privately-owned Chinese companies are the leading global producers of EVs and batteries, and nearly one-third of molecules sourced by big pharma though licensing deals last year came from China, up from 10% in 2020.

China will remain a key part of global supply chains, regardless of tariffs and talk of decoupling. Since Trump first launched his trade war in 2018, China’s share of global exports has risen to 15% from 13%.

China is likely to continue to account for about 20% of global economic growth, larger than the combined share of growth from the US and its G-7 developed nation partners. Exports are a relatively small part of China’s GDP and GDP growth, so whatever Trump decides to do with tariffs will hurt American consumers and companies more than China.

Stock markets don’t necessarily reflect the health of an economy. But, since the start of this year, as well as over the last 12 months, the MSCI China index has significantly outperformed the MSCI all country world index and the S&P 500. At a minimum, this suggests paying more attention to the risks and opportunities in China’s economy.

A Course Correction Is Underway In Beijing

For China, the world’s second-largest economy, the greatest challenge comes from the Zhongnanhai leadership compound in Beijing, not from the White House.

First, it is important to recognize how entrepreneurial China has become over the past few decades. When I first worked in China in the early 1980s, shortly after China started its economic reforms, there were no private companies. Today, privately-owned, entrepreneurial companies account for about 90% of urban employment and about 90% of China’s tech sector. This means the majority of urban consumers are either entrepreneurs or employees of private firms.

Figure 1. China Is Entrepreneurial

Unit: Millions

Source: CEIC

Private firms drive China’s growth in jobs, innovation and wealth.

But, those firms have suffered in recent years, in large part because of regulatory chaos and doubts about Xi’s support for the private sector. That led to a collapse in confidence among China’s entrepreneurs and consumers.

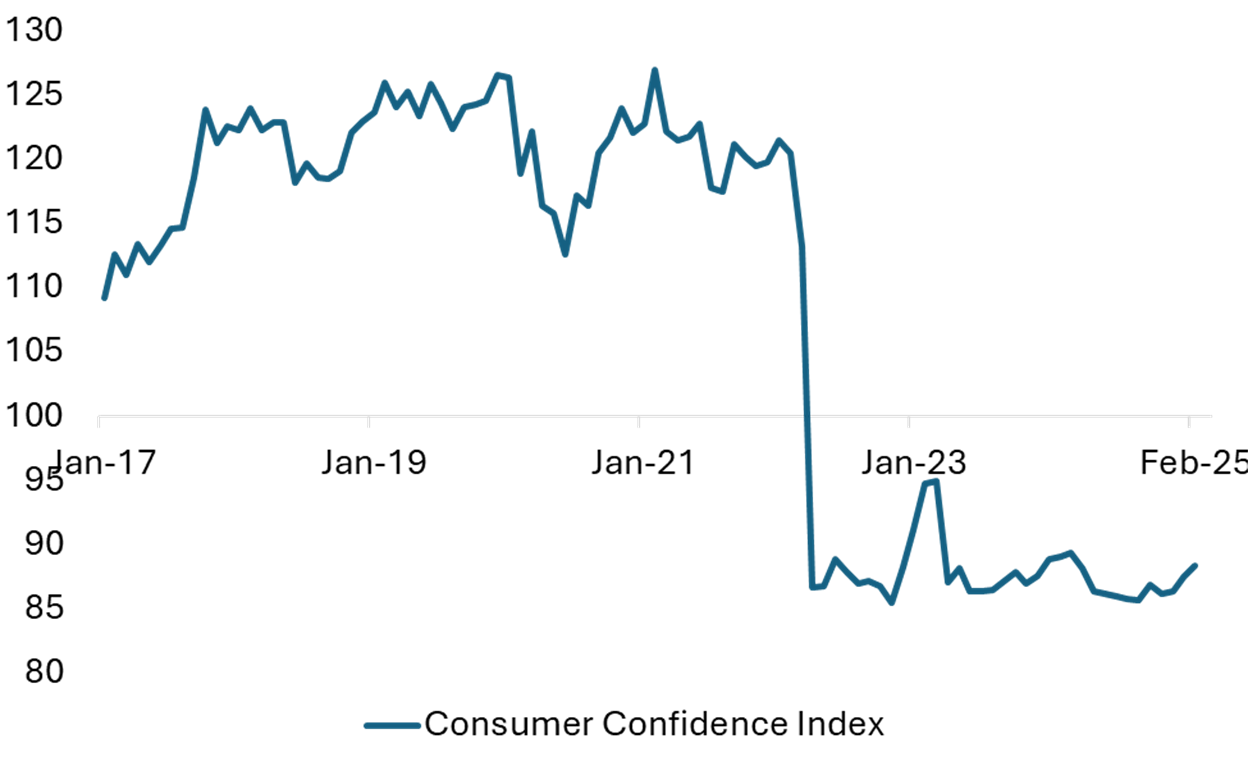

Figure 2. Consumer Confidence Low

Source: CEIC

Last fall, however, Xi began to acknowledge his policy mistakes, with modest changes in rhetoric and policy designed to restore confidence.

In recent weeks, the pace of that return towards pragmatism accelerated. In a February meeting with leading tech entrepreneurs, including the founders of Alibaba (Jack Ma) and DeepSeek, as well as leaders of CATL, BYD, Tencent, Xiaomi, Huawei and Unitree Robotics, Xi said, “It is time for private enterprises and private entrepreneurs to show their talents” and that his government “must resolutely remove various obstacles” faced by private firms.

A couple of weeks later, during the March meeting of the legislature, Xi said, “I have always supported private enterprises, and I have worked in places where the private economy is relatively developed.” While this rhetoric may not impress western listeners, this is, for Xi, a strong signal of support for entrepreneurs.

At the same time, Xi’s deputy, Premier Li Qiang, delivered China’s version of a state of the union address, the government work report, which, for the first time, called for policies to stabilize the property and stock markets, where the bulk of middle-class household wealth is concentrated.

The work report also said the government’s top priority this year is “vigorously boosting consumption . . . and stimulating domestic demand across the board.” This is the first time consumption, rather than industrial production, is the policy focus.

The work report also set an ambitious 2025 GDP growth target of 5%, signaling that Xi is prepared to take additional steps to restore confidence – and respond to Trump tariffs – as necessary.

Another positive sign was that the typically conservative Ministry of Finance finally agreed to raise its fiscal deficit target from 3% to 4% of GDP, the highest level in decades, and said it has capacity for additional stimulus.

Revitalizing Consumption Is Now Xi’s Top Political Goal

Most importantly, on March 16, the leadership of the Communist Party (the CCP Central Committee) and the government (the State Council) jointly issued a “special action plan to boost consumption.” The document did not include policy details, but it did make clear that Xi’s top political objective is restoring confidence and domestic demand. This means he is likely to do whatever it takes to achieve that goal, although it may take a few quarters before the macro data reflects success.

Is This The Real Thing?

In recent years, the policy pendulum swung too far in the wrong direction, leading to disappointing growth rates. And Xi has been too stubborn to change direction. In my view, his recent words and policies - such as cutting the cash downpayment requirement for a new home from 25% to 15% of the purchase price - have signaled that he understands there is a serious confidence problem and he is ready to course correct back towards the pragmatism that led to a 150% increase in per capita household income since he became head of the Communist Party in 2012. (For context, during that period of time, per capita household income in the US rose 61%.)

This does not guarantee that he will do what it takes, but the odds are that he will. China is not a democracy, but its leaders still depend on popular support, which is, as in all countries, based largely on the health of the economy.

It is important to recognize that the recent regulatory chaos was not caused by an ideological opposition to entrepreneurs and markets. Rather, Xi was attempting to address the same socio-economic concerns that most democracies are wrestling with, from income inequality to unequal access to education and health care and housing affordability. Unfortunately, implementation of these policies was often poorly managed. Policy objectives were not accomplished, and unintended consequences damaged commercial activities and entrepreneurial confidence.

Xi has said he wants to “enhance the ability to get rich,” and that “small and medium-sized business owners and self-employed businesses are important groups for starting a business and getting rich.” He said, “It is necessary to protect property rights and intellectual property rights, and protect legal wealth.” Xi now needs to persuade his nation of entrepreneurs that he is serious about that.

This is critical because entrepreneurs are the engine of China’s economic growth, the reason China has become wealthy, and the reason the Chinese Communist Party has remained in power for so long. Xi must recognize this, because he worked in some of China’s most entrepreneurial places during his long career and his late father, Xi Zhongxun, oversaw the early market-oriented reforms in Guangdong, from 1978 to 1980.

It's also worth keeping in mind that while the economy is weaker than it should be, it is far from collapse. For example, last year, per capita household income rose 5% YoY. Electricity consumption, a good proxy for industrial activity, rose almost 7% YoY and was 35% higher than in pre-COVID 2019.

Xi’s Challenge

Xi’s objective should be to restore the composition of China’s economic growth back to its pre-pandemic state.

In the five years through 2019 – including the first two years of Trump’s first trade war – net exports (the value of a country’s exports minus its imports, because GDP measures domestic production) accounted for only 1% of average annual GDP growth. Final consumption contributed an average of 64% of GDP growth, with the balance from gross capital formation.

That model was disrupted when confidence collapsed and domestic demand softened, so that last year, net exports contributed 30% of China’s GDP growth.

Even without more Trump tariffs, last year’s mix is unsustainable. Only 15% of China’s exports go to the US, but exports can’t be China’s future. China already has the world’s largest share of global exports and manufacturing, so the country’s future growth will have to be sourced domestically.

To accomplish that, Xi must return to a regulatory and political environment that restores confidence among his country’s entrepreneurs and consumers.

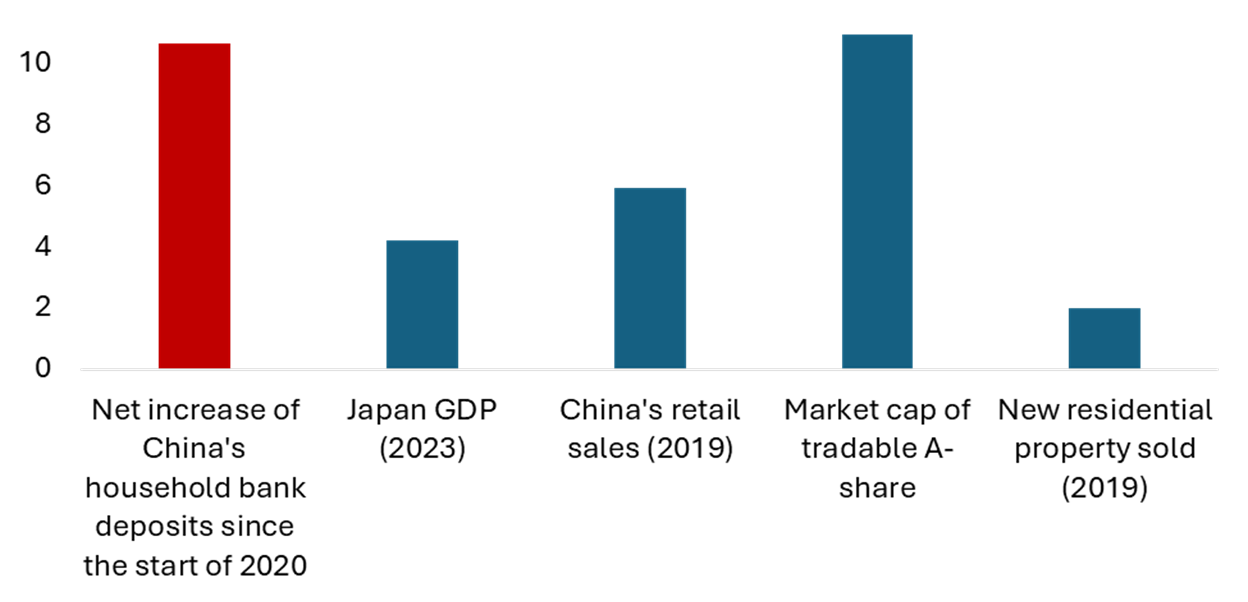

When confidence does return, the resilience of Chinese entrepreneurs and consumers will be supported by a massive increase in savings. The net increase in household bank accounts since the start of 2020 is equal to US$10.7 trillion, which is more than double the size of Japan’s 2023 GDP.

This could be significant fuel for a consumer spending rebound, as well as a sustainable recovery in mainland equities, where domestic investors hold more than 95% of the market.

Figure 3. Household Deposits In Context

US$ Trillion

Sources: CEIC. China’s household bank deposits and A-share market cap are by February 2025.

Decoupling Isn’t Happening, So Don’t Ignore China

American politicians may talk about decoupling from China, but investors, companies and consumers can’t ignore China.

From consumer electronics to medicine and critical minerals, China will continue to be an important part of global supply chains. China is the world’s leading producer and exporter of active ingredients for pharmaceuticals, and Chinese companies dominate production of 16 of the 18 critical materials for energy identified by the US Department of Energy.

The China market is also an important opportunity. Since China joined the WTO in 2001, it has been the US’ fastest growing export market, supporting tens of thousands of American jobs. US exports to China have increased 646% over that time, while US exports to the rest of the world rose 171%. US agricultural exports to China are up 1,200%, compared to a 174% increase to the rest of the world.

Figure 4. Growth Rate Of US Goods Exports To Its 10 Biggest Markets, Since China Joined the WTO in 2001

Source: CEIC, data for 2001 to 2024

And DeepSeek won’t be the last Chinese company to surprise foreigners. BYD now sells more EVs than Tesla. CATL is the world’s top battery maker. About 30% of big pharma deals with at least US$50 million up-front involved Chinese companies last year, up from none five years ago.

The World Intellectual Property Organization (WIPO) ranks China as the 11th most innovative economy, ahead of France, Japan and Israel.

Chinese-born scholars and engineers working in the US are key to the ability of American AI companies to compete with firms in China. After completing a PhD in the US, the vast majority of non-American AI talent stays in the US, according to a study published last year by the Paulson Institute’s Macro Polo team. As a result, in 2022, of the top-tier AI researchers working in US institutions, 38% were born in China, compared to a 37% share who were born in the US.

Jay Powell Has The Last Word

“You would expect that expectations of inflation over the course of a year would move around because conditions change and in this case we have tariffs coming in. We don’t know how big. There are so many things we don’t know. But we kind of know there are going to be tariffs and they tend to bring growth down. They tend to bring inflation up in the first instance.”

[from Fed Chair Powell’s March 19 press conference]