Something funky is happening in China’s economy.

Over the past several months, we’ve seen a sudden and dramatic slump in fixed asset investment (FAI).

FAI may not sound especially sexy. But it’s a bulwark of China’s economic growth, covering everything from roads to rail, ports to bridges, and factories to homes.

And since the summer, it’s been shrinking fast.

Back in July, FAI dipped into the red, declining just 0.1% y/y.

But since then, the decline has gone into freefall — plunging 12.2% y/y in October.

This is unprecedented.

Outside of the pandemic, China has never seen this many consecutive months of contracting FAI.

Some commentators say this drop-off is an early sign of economic meltdown.

Others claim the stats bureau must have botched the numbers.

In reality, it’s neither.

As we discuss in the latest Trivium China Podcast, the drop in FAI reflects a perfect storm of local governments’ reaction to recent policy signals, economic headwinds, and shifting local priorities — all of which are hitting investment across real estate, manufacturing, and infrastructure.

Our most recent blog post lays out this research in full, but for now, here is a quick overview of what’s happening.

The anti-involution push

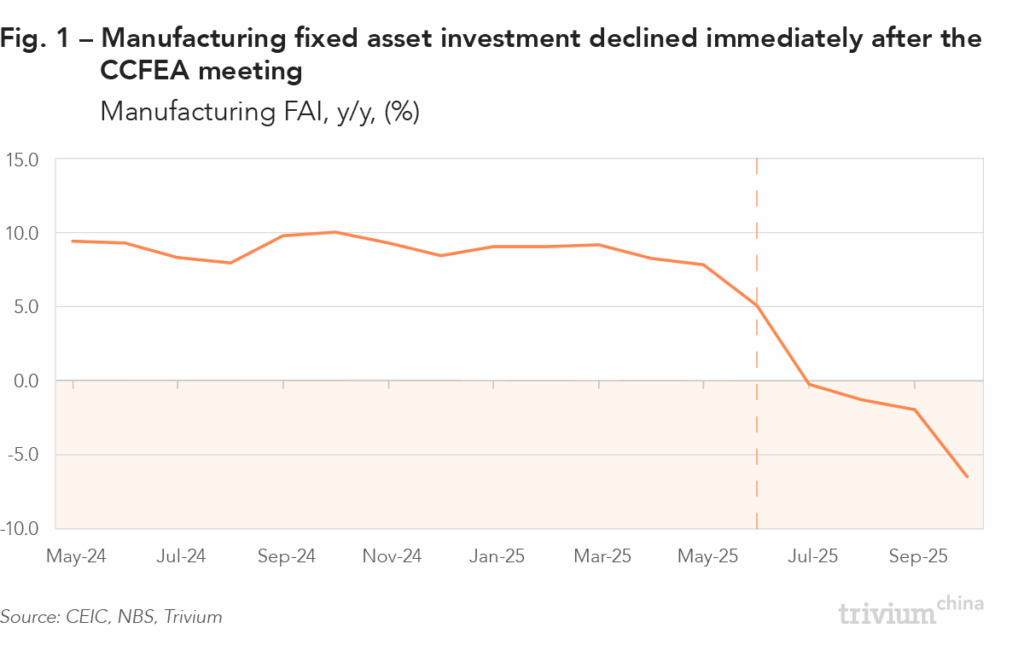

After an impressive 59 months of consecutive growth, manufacturing investment slipped into the red in July and has continued to decline — at an accelerating pace — ever since.

Much of this pullback reflects Beijing’s campaign against overcapacity.

In early July, the Central Commission for Financial and Economic Affairs (CCFEA) — the Party’s top economic policymaking body — pledged to crack down on the “involution-style” competition plaguing China’s economy, from petrochemicals to electric vehicles (NEVs), and cleantech to metals.

Since then, there has been a flurry of industry meetings, guidelines, and ministerial symposiums aimed at encouraging various sectors to reduce excess capacity.

And it’s working — since July, FAI in the plastics, chemicals, cleantech, and non-ferrous metal industries has rapidly declined.

Local government bonds and redirected investment

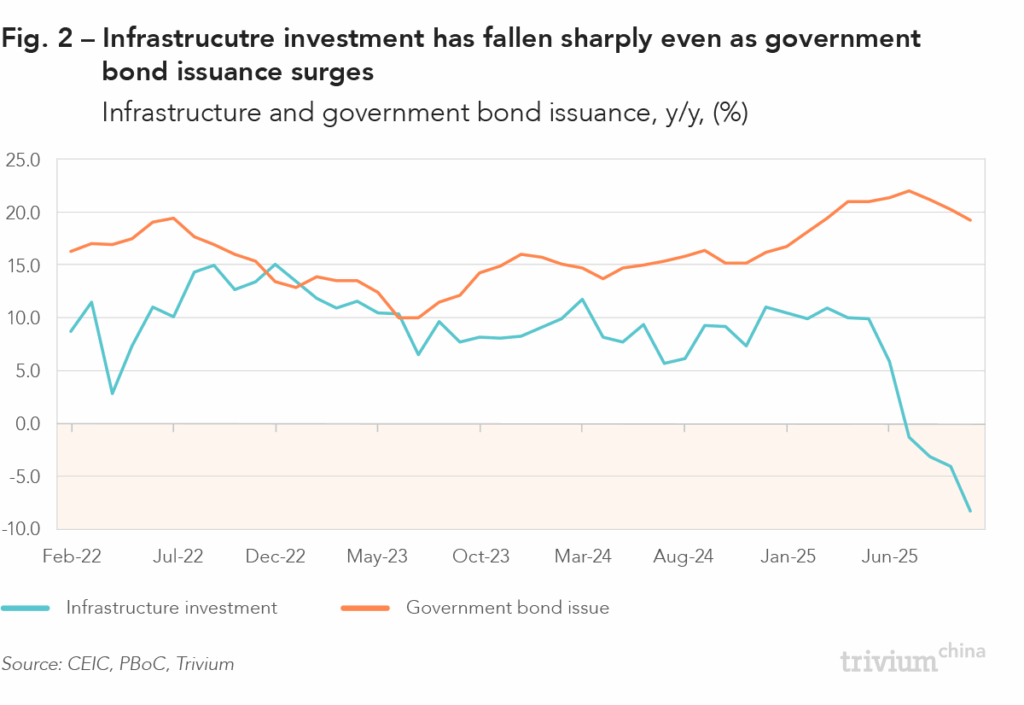

Since July, infrastructure spending has also declined by approximately RMB 387 billion relative to 2024 levels, representing a 4.4% drop. At the same time, issuance of government bonds — the main debt instrument used to fund public infrastructure — has soared.

So where has the money gone?

This year, the Ministry of Finance (MoF) expanded the use of local government special-purpose bonds (SPBs) — a debt instrument typically used to fund infrastructure investment — to allow localities to pay down hidden debt obligations.

The MoF provided an RMB 800 billion quota for this purpose.

However, bond issuance data shows that local governments have spent around RMB 1.32 trillion this year paying down hidden debt.

This additional RMB 500 billion beyond the MoF quota likely came from funds originally earmarked for infrastructure — dragging on aggregate FAI.

Real estate and upstream spillovers

Real estate investment — accounting for roughly one-fifth of China’s aggregate FAI — contracted 23.0% y/y in October, the fastest decline since the property slump began in 2021.

Remarkably, the rate of decline has accelerated every month this year, making real estate a major contributor to the aggregate FAI slowdown.

The property sector is also closely intertwined with upstream industries supplying raw and processed construction materials.

As developers scale back construction, demand for materials like steel, glass, bricks, and cement drops, leading manufacturers in these sectors to pull back on FAI.

These second-order spillover effects further exacerbate the decline in aggregate FAI, far beyond real estate.

Putting it all together: China’s FAI decline is multifaceted, and clearly a drag on wider economic activity.

That said, outside the investment and related real estate slumps, China’s broader macro data remains pretty resilient.

Industrial output continues to expand at a pace broadly in line with pre-pandemic trends.

And while consumption is soft at the headline level, spending on services remains firm.

The outlook for exports is also positive, especially given tentative signs of recovery in shipments to the US.

These areas of resilience help offset the drag from weakening investment and reinforce the picture of an economy that may be cooling but is far from stalling.

Joe Peissel, Lead Macro-econ Analyst, Trivium China

What you missed

Econ and finance

Beijing wants government spending to prioritize long-term upgrading of the economy.

In a November 14 interview with Xinhua, Finance Minister Lan Fo’an pledged to: “Optimize the direction of government investment…and channel more funds into projects of strategic importance that help raise total factor productivity.”

As far as we know, this is the first time policymakers have explicitly stated they want government investment to focus on raising total factor productivity.

Business environment

A new AidData report released on November 18 maps China’s USD 2.2 trillion in state-financed overseas loans and grants between 2000 and 2023. The report rebuts a widespread narrative that China’s overseas loan-making efforts have slowed, instead illustrating that:

China has spent over USD 100 billion annually for the last decade and is the world’s largest official creditor.

China outspent the US on overseas lending “on a more than two-to-one basis” in 2023.

Corporates

Domestic electric vehicles (EVs) are locking in their market dominance. Per the China Passenger Car Association’s retail sales data for October:

Total auto sales came in at 2.242 million — down 0.1% m/m and 0.9% y/y.

Meanwhile, NEV sales held steady near all-time highs, at 1.282 million — down 1.3% m/m after a stellar September, and up 7.2% y/y. This allowed NEVs to claim a 57.2% share of market sales last month.

Tencent’s Q3 capex — a proxy for AI infrastructure investment — fell hard, coming in at RMB 12.98 billion, down 24% y/y and 32% q/q.

The company also said it won’t hit its annual capex target — which was guided to be in the “low teens” as a percentage of revenue.

Tencent attributed the drop in spending to “a change in AI chip availability” — in other words, Beijing’s ban on Nvidia’s H20 imports has resulted in a drop in semiconductor spend.

Tech

On Tuesday, Yicai published an article describing several ways that low-altitude vehicles are already being used in China, which helps answer a frequent question we get from our readers: are there really any economically viable use cases for autonomous low-altitude flights? Yicai cites the following examples:

Cherry farmers in Dalian are using drones to lower the cost of agricultural logistics.

Drone-based medical logistics flights reduce the inter-city transfer time of blood for emergency surgeries to 15 minutes, skirting traffic congestion.

Law enforcement agencies in Harbin are using autonomous drones to patrol long stretches of waterway more efficiently than by boat.

Foreign affairs

Beijing reportedly informed Tokyo it would stop accepting required inspection certificates for Japanese seafood imports — effectively undoing recent progress on reversing a blanket ban on all Japanese aquatic products in place since August 2023.

This was in response to Japanese Prime Minister Sanae Takaichi’s recent remarks that a “Taiwan contingency” could constitute a “survival-threatening situation” for Japan.

Beijing has also reportedly suspended talks to resume imports of Japanese beef into China.

Xi Jinping and Premier Li Qiang met with Thailand’s king on November 14 in Beijing — and love was in the air.

King Vajiralongkorn is the first reigning Thai monarch to visit China since the two countries normalized diplomatic relations 50 years ago.

Both of China’s head honchos described the two countries as “one family.”

U.S.-China

On Thursday, Reuters reported that the Trump administration might delay moving forward on Section 232 investigations into semiconductors to avoid further provoking China.

If true, this would be unprecedented — no action that China has ever taken has resulted in the US holding fire on the roll-out of planned executive branch actions.

Beijing will read this as proof that hitting back hard with rare earth controls is the right strategy to deal with the Trump administration.

On November 15, the Financial Times reported on a White House memo that accuses Alibaba of giving the Chinese military access to US user data, saying:

“Alibaba provides the Chinese government and PLA with access to customer data that includes IP addresses, WiFi information and payment records, as well as different AI-related services.”

Alibaba called the allegations “complete nonsense,” while Liu Pengyu, spokesman for the Chinese Embassy in Washington, DC, posted this on X: “It is extremely irresponsible and is a complete distortion of facts.”

As always, it was a busy week in China.

Thank goodness Trivium China is here to make sure you don’t miss any of the developments that matter.